Why Staying on Top of Bills Matters

Missing a bill payment may not seem like a big deal in the moment, but over time it can chip away at your financial stability. Late fees, interest charges, and hits to your credit score add unnecessary stress. Just as working with the best debt relief companies can help people rebuild from overwhelming debt, building a solid bill tracking system helps prevent problems before they spiral. It’s not about being perfect with money but about staying consistent with simple habits that make your financial life smoother.

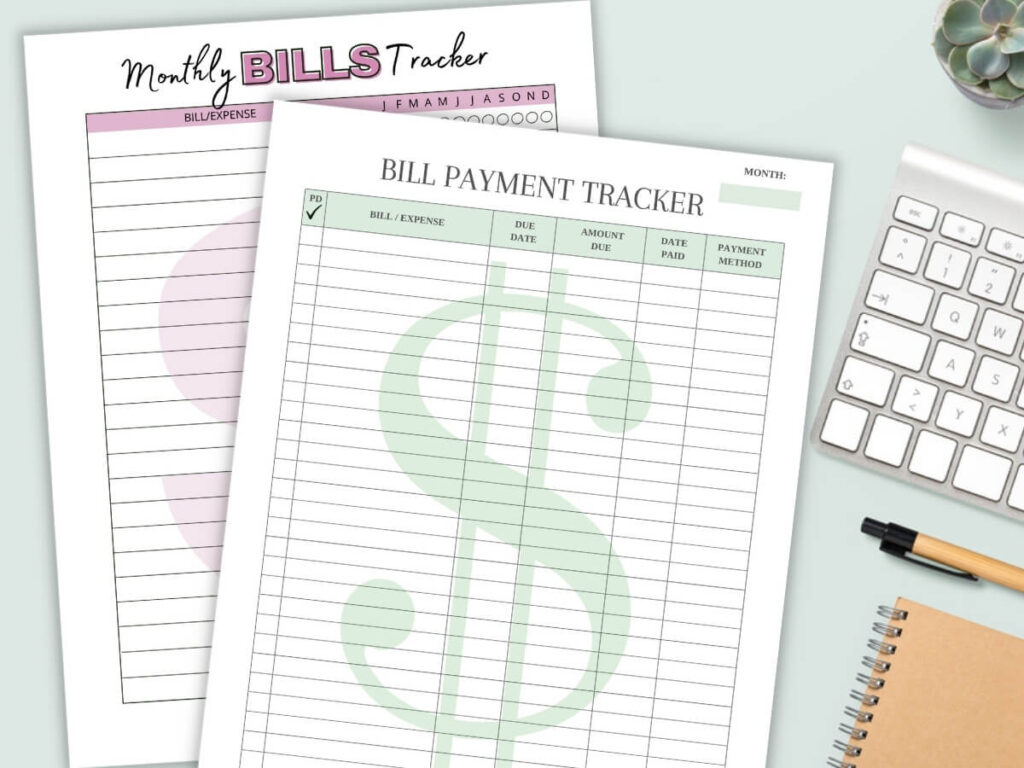

Start with a Centralized System

The first step is gathering all your financial obligations in one place. Many people lose track of payments simply because they’re scattered across different platforms—paper statements, emails, apps, and online accounts. Whether you prefer a digital spreadsheet, a budgeting app, or even a simple notebook, the key is having a single hub that lists due dates, amounts, and payment methods. This gives you a clear snapshot of what needs attention and helps you avoid surprises.

Leverage Automation Where You Can

Automation is one of the easiest ways to simplify bill tracking. Most companies allow you to set up automatic payments for recurring bills like utilities, insurance, or loan payments. Automating ensures you never miss a due date, and it frees up mental energy to focus on bigger financial goals. If you’re hesitant to automate everything, you can still automate essentials while manually handling bills that fluctuate each month, like credit card balances, so you can review them before paying.

Use Calendar Reminders to Stay Ahead

Even with automation, it’s smart to set up calendar reminders a few days before each bill is due. This not only acts as a safety net but also gives you a chance to double-check that your account has enough funds. You can use a digital calendar that syncs across your devices or even a physical wall calendar if you prefer something visual. Consistent reminders create a rhythm that keeps bill-paying stress-free.

Consider Bill Tracking Apps

There are several apps designed specifically for tracking bills, and many of them link directly to your bank accounts to update balances in real time. These tools can send push notifications for upcoming due dates and provide monthly reports showing where your money is going. By using an app, you gain more insight into your habits, which can also help you spot areas to cut back and save. The key is choosing a tool you actually enjoy using so that it becomes a part of your routine.

Bundle and Streamline Payments

Another helpful approach is consolidating bills whenever possible. Some financial institutions allow you to bundle payments so multiple bills come due on the same day. This reduces the number of due dates you need to remember and simplifies your monthly cash flow. Similarly, scheduling all payments right after your paycheck arrives ensures that essentials are covered first before discretionary spending. Streamlining not only saves time but also makes budgeting more predictable.

Review and Adjust Regularly

Your financial situation isn’t static, so your bill tracking system shouldn’t be either. Reviewing your bills every month helps you stay on top of changes like rate increases, new subscriptions, or old services you no longer use. Cancelling unused subscriptions or negotiating lower rates on recurring services can reduce your monthly obligations. Regular reviews keep you from paying for things that don’t add value and allow you to adapt your system as your financial goals evolve.

Create a Cushion for Flexibility

Sometimes life throws unexpected expenses your way. Having a small financial cushion—whether in a separate checking account or a dedicated emergency fund—ensures that a surprise bill doesn’t derail your entire system. Even setting aside a modest amount each month provides peace of mind that you can handle curveballs without missing payments or racking up fees.

Why This Matters Beyond the Bills

Making bill tracking easy and effective is about more than avoiding late payments. It’s about building confidence in your financial management skills. When you know your bills are covered, you reduce stress and free up mental space to focus on goals like saving, investing, or building experiences that matter. It’s the foundation of a healthier financial life, where money feels like a tool you’re in control of, not something that constantly surprises you.

Final Thoughts

An effective bill tracking system doesn’t need to be complicated. By centralizing information, using automation wisely, setting reminders, and reviewing your system regularly, you can create a process that works seamlessly in the background of your life. The payoff is not just fewer late fees but greater peace of mind, more control, and the ability to focus on what really matters to you. In the end, making bill tracking easy and effective is one of the simplest yet most powerful ways to strengthen your overall financial well-being.