You just got a great opportunity—maybe a bulk order from a new client or a chance to expand your operations. But there’s one issue: your cash flow isn’t in the best shape to take it on. While you wait for pending payments to clear, the opportunity might slip away.

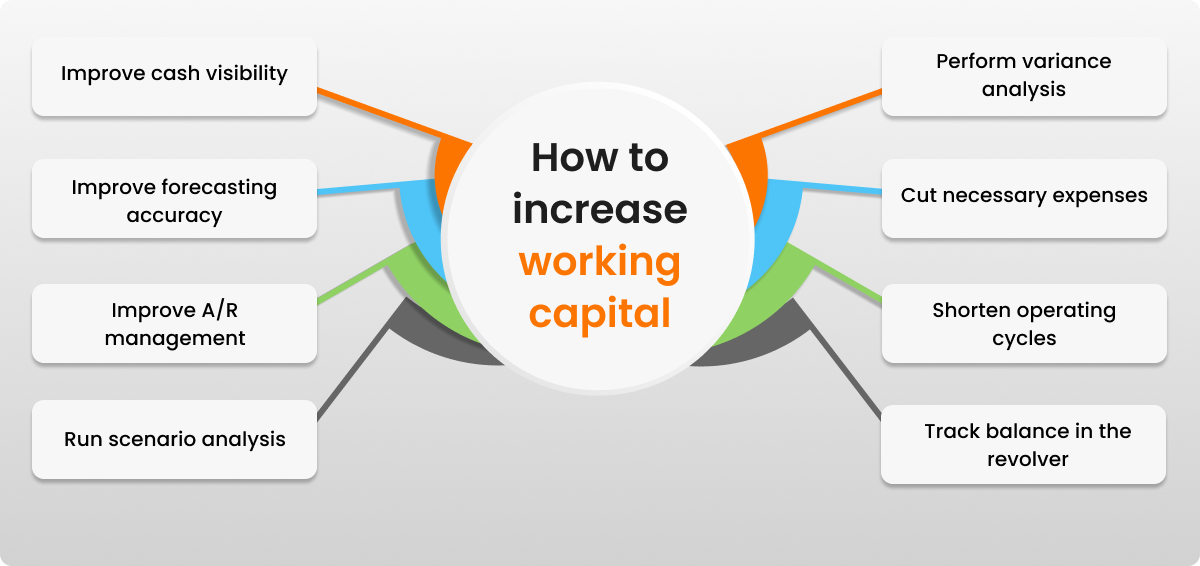

This is exactly where optimising your working capital comes in. Smart financial management prevents cash shortages from slowing growth. Here’s how to improve cash flow and stay ready for new possibilities.

What is working capital and why is it important

Simply put, working capital is the money you have available for your daily operations. It’s calculated as:

Working Capital = Current Assets – Current Liabilities

- Current assets include cash, accounts receivable and inventory.

- Current liabilities include accounts payable, short-term loans and other financial obligations due soon.

If your working capital is positive then it means your business can cover its short term debts comfortably. If it’s negative then you may struggle to pay bills on time which affects your overall financial health.

Step 1: Streamlining receivables

One of the most common reasons businesses face cash flow issues is delayed payments from customers. If your money is stuck in unpaid invoices then it’s time to take action.

- Set clear payment terms by reducing the payment period from 60 days to 30 days to improve cash flow.

- Encourage faster payments by offering a small early payment discount such as 2%.

- Use digital invoicing with automated reminders and online payment options to streamline collections.

- Implement a late fee policy to prevent unnecessary payment delays while maintaining customer relationships.

Step 2: Managing payables

Just as you want to get paid faster, you also want to delay outgoing payments strategically. The longer you hold onto your cash, the better your liquidity.

- Negotiate with suppliers to extend payment terms from 30 days to 45 or 60 days for better cash flow.

- Use interest free credit periods offered by suppliers to delay payments without extra costs.

- Check if bulk purchasing discounts make sense financially and increase order size if it saves money.

Step 3: Keeping inventory under control

Too much inventory means cash is locked up in unsold products. Too little inventory and you might struggle to meet customer demands. Finding the right balance is key.

- Order stock only when needed with just in time inventory practices to avoid excess holding.

- Analyse past sales data to predict demand accurately and optimise inventory levels.

- Clear slow moving stock with discounts or bundle deals to free up space and cash.

Step 4: Using business loans wisely

If your working capital is low then a business loan can help if used smartly. Check your eligibility before applying to meet the lender’s requirements. Here’s what lenders consider for business loan eligibility.

- Your business’s age and turnover

- Credit score and financial statements

- Profitability and cash flow health

- Existing liabilities

Based on your needs, you can explore term loans or working capital loans to cover daily expenses. A business loan interest rate calculator estimates costs and checks if the EMI fits your budget.

Step 5: Cutting unnecessary costs

Sometimes the best way to improve working capital is simply by cutting down expenses that don’t add value.

- Review expenses regularly to find and reduce nonessential recurring costs.

- Switch to vendors offering similar quality at lower prices to save money.

- Use automation to reduce manual work and cut operational costs efficiently.

Step 6: Leveraging automation

Automation improves working capital by reducing manual work. Faster processes make cash flow management easier.

- Automate invoicing and payment follow ups to avoid delays and ensure timely payments.

- Track inventory digitally to prevent overstocking or running out of stock.

- Automate expense management to streamline tracking and reduce unnecessary spending.

Step 7: Continuous monitoring

Working capital needs regular monitoring since business conditions keep changing. What works today may not be effective in six months.

- Monitor key financial indicators like receivables, payables and cash cycles to detect trends early.

- Adjust working capital strategies as your business grows or changes.

- Be ready to adapt to market shifts, supplier policies and customer payment habits.

Managing working capital isn’t just about maintaining cash flow. It’s about keeping your business stable and ready to grow. With the right approach, you can avoid cash shortages and adapt to market changes. This financial control helps you run operations smoothly, seize new opportunities and stay ahead.

If you need external funding then customised solutions like working capital loans can help bridge short term gaps without disrupting operations. The key is to plan wisely, explore the right financial options and make informed decisions that support your long-term success.